There were 2 new important changes made on the KOSPI200 Products starting in September 1, 2014

1. There was introduction to Long-term Settlement Contracts

Settlement month setup

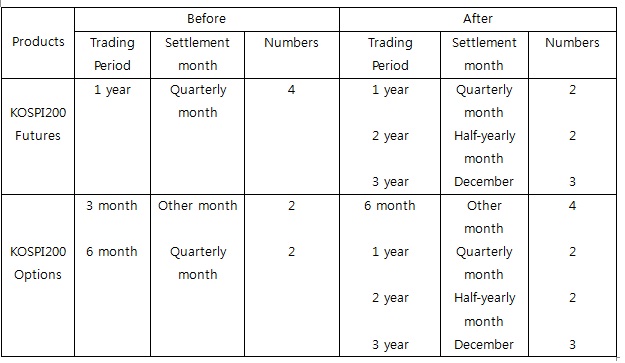

- 3 additional settlement contracts to be listed for KOSPI200 futures, 7 additional settlement contracts to be listed for KOSPI200 options.

[KOSPI200 Futures and Options contract month]

-Currently there aren’t too many trades on the new longer contract months, but KRX in the upcoming months will look to reflect the new KOSPI200 Future contracts on the CME Night Session.

2. Block Trades have been enabled for KOSPI200 Futures and Options

Currently the Block Trades have been only for KTB, Currency Futures, but KRX has now enabled it for the KOSPI200 Futures and Options. Currently the minimum contract size is at 100 lots. There has been a growing interest and KRX views it to be quite successful, especially because now it brings some flow that was done OTC into the Exchange.

The Exchange is very keen to improve this market further as it is bringing more interesting flows to the market, and will hold an info session tomorrow Friday seeking feedback from representatives of each KRX members in charge of entering block trades.